In today’s complex travel ecosystem, banks, credit card issuers, and insurance providers are no longer just facilitators—they’re key enablers of global mobility and protection. But the evolution of airline retailing brings growing challenges:

To stay competitive, financial institutions must deliver secure, personalized, and seamless travel benefits—all while managing risk, compliance, and rising customer expectations.

Key Benefits

Real-time visibility into ticket status and policy-level data ensures proactive resolution and fewer disputes.

Instantly validate disruption-related claims with airline-verified data to cut false positives and speed payouts.

Enable smarter redemptions (points + cash) and embed rich travel content to deepen cardholder engagement.

Offer unused ticket audits, smart fare tracking, and embedded coverage as white-labeled perks.

Leverage intelligent payment orchestration to increase approval rates and lower processing costs across channels.

Unlock the Growing $20B+ Travel Insurance Market.

The global travel insurance sector is expanding at over 15% annually—driven by rising traveler demand for protection, seamless booking, and embedded coverage at the point of sale.

Partnering with TWAI’s Travel Retailing Suite empowers insurance providers to tap directly into this momentum. Through GQ Retail, GQ B2C, GQ Dynamic, and AccessOne, insurers can seamlessly integrate products into airline and travel ecosystems—reaching customers in-channel, at the moment they book.

GQ Pay helps credit card networks and payment providers grow transaction volume, boost approval rates, and gain strategic placement in the fast-growing $1T+ global travel market. Integrated directly into airline and OTA checkouts, our payment orchestration turns every booking into a high-value opportunity for your brand.

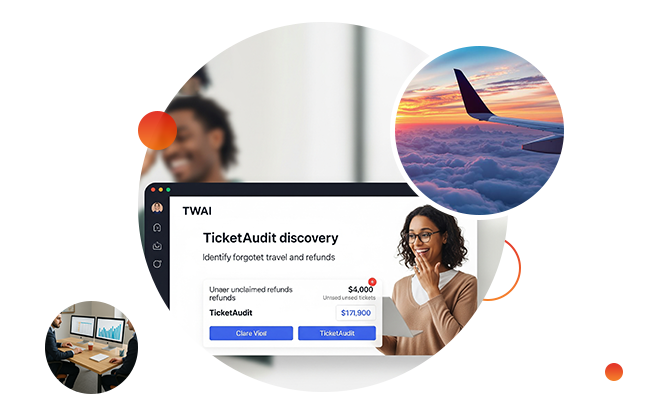

Discover Hidden Refunds. Deliver Premium Value.

TicketAudit helps credit card and travel insurance providers uncover unused airline tickets and unclaimed refunds—turning forgotten travel into a powerful value-added service.

Deliver smarter service, improve customer trust, and unlock new loyalty opportunities.

Let’s Turn Missed Trips Into Meaningful Moments Deliver real value where your customers least expect it.